President Joe Biden’s signature program, the child tax credit started delivering monthly checks to parents from July 15. American families can receive as much as $300 per child every month. The program’s $2 trillion American Rescue Plan’s expansion passed in March is finally in motion. Read to know all about it.

What can families expect from the child tax credit program?

Families with children under the age of 17, born by the end of this year are eligible for the program. In this program, families will receive $300 per child under the age of six. However, they should have a joint income that adds up to $150,000 or less. Additionally, families with children between the ages of 6 and 17 years, will receive up to $250 per child per month.

However, households with earnings over $150,000 and below $400,000 per year, will receive periodic payments that add up to $2,000 per child. The monthly payments will be made through December, on the 15th of each month. However, it will be delayed by a day or two if the 15th of the month is a weekend or a holiday. With the help of this program, families will receive a sum of $300 and $250 per month, for each child under the age of 6 and 17 respectively.

Can you get this tax credit even if you don’t pay taxes?

Yes, you can avail of this benefit even if you don’t pay taxes. However, it involves an extra step. If you have an income that is low enough to not need to pay taxes, you can apply using the IRS portal. The online portal is very similar to the one used to distribute stimulus checks last year.

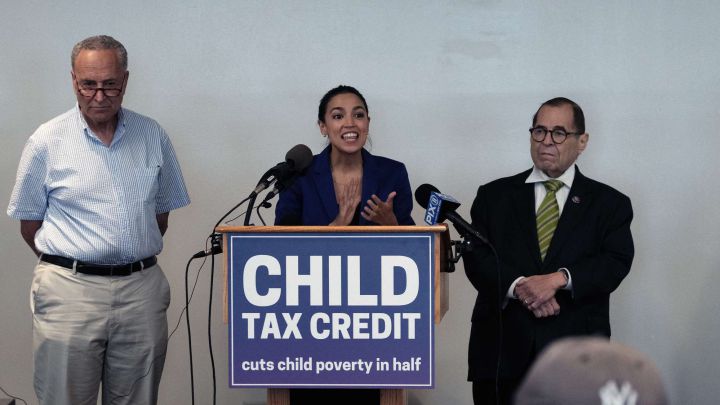

Moreover, this version of the credit will expire in 2021. And, President Biden has been reluctant in advocating for this law due to the cost associated with it. However, the White House proposes to extend it till 2025, when few other republican tax changes are due to expire. The legislatures explained the program as “the most significant policy to come out of Washington in generations”. “Congress has a historic opportunity to provide a lifeline to the middle class and to cut child poverty in half permanently,” They stated.