You’ve decided to start investing in mutual funds regularly. That’s a great concept! The value of managed assets in India’s mutual fund sector has increased from Rs. 11.73 trillion to Rs. 25.49 trillion since June 2015, more than doubling the initial investment in only five years. As a result, more Indian investors are becoming aware of the benefits of mutual funds and how they operate. However, there are several typical investment-related falsehoods that you should be aware of in the mutual fund sector. Let’s look at the top 5 myths about mutual funds so you can make an informed decision before investing.

Top 5 myths about mutual funds

Myth 1: You must put a large amount of money into mutual funds

The first widespread myth regarding mutual funds that most potential investors hear is that they must have a sizable bank account with five-figure sums or even lakhs to invest in this product. This is no longer the case; in fact, there is no longer any requirement for a one-time commitment.

Most mutual fund (MF) firms provide a simple Systematic Investment Plan (SIP). You may invest small sums every month (as little as 500/-). You may use the power of compounding and market returns to develop a healthy fund by investing in SIPs every month.

Myth 2: MFs are completely risk-free

Customers frequently hear, “Mutual funds are subject to market risks,” after seeing a mutual fund commercial or promotion. Mutual funds investing in the equity market, like corporate stocks, are vulnerable to crashes or a drop in their net asset value (or NAV).

Even if you invest in a government bond-based fund, which is regarded as reasonably secure, there is a danger of losing money if interest rates fluctuate dramatically in the future. The risk is proportional to the projected profits.

Most investors assume that all mutual funds are well-managed by all fund managers and give assured returns. It is a prevalent fallacy. This isn’t the case. Before you invest, double-check that your fund is well-diversified and has a solid track record. Mutual funds that promise high returns in a short period of time might be dangerous.

Myth 3: To make money, you need to be an expert in mutual funds

This third misconception is only partially correct. Since 2013, investors have been able to acquire mutual fund schemes through direct plans. It allows them to utilize their own expertise instead of going via an intermediate business or agent, saving money on commissions.

Most MF schemes are normal plans in which you do not need to be an expert to invest. To distribute your money properly and assure strong returns, MF firms leverage their own expertise and the market knowledge of their fund managers.

Myth 4: MFs only invest in the equity market

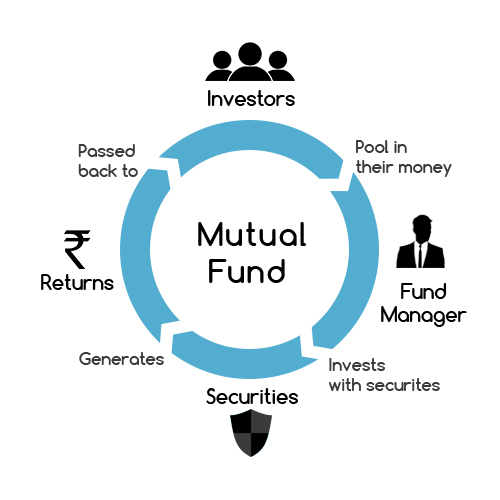

Another prevalent myth among investors is that because MFs exclusively invest in equities or equity-related assets, they may offer better returns than other financial instruments. The truth is that there are several sorts of mutual funds. It can invest your money in various securities such as equity, debt, real estate, and government bonds.

The risk and returns from the fund might differ depending on the MF type. “Pure” equities funds carry a high level of risk and provide large returns. “Debt” funds are safer but give lower returns. “Balanced” funds are a mix of equity and debt that may provide outstanding returns over a three to five-year investing period.

Myth 5: Investing in mutual funds requires a long-term commitment

Most investors’ first perception of mutual funds is that they are long-term investments. While long-term investment (such as 5 years) might yield strong results, there are several MF categories, such as short-term debt or liquid funds. They can outperform other instruments such as fixed or recurring deposits.

So, the next time you want to save money for a family trip, consider some of the greatest short-term debt or income funds that may assist you in earning a lump sum amount.