Gold coins are no longer in circulation as currency but, they are still worth their weight and more! Gold never really loses its value, even amidst a pandemic when you can’t go to a store and buy or sell it. How, wGold coins are no longer in circulation as currency but, they are still worth their weight and more! Gold never really loses its value, even amidst a pandemic when you can’t go to a store and buy or sell it. How, well digital gold of course! It’s safe and a great investment. Read to know all about it.ell digital gold of course! It’s safe and a great investment. Read to know all about it.

What is digital gold?

As soon as you invest in gold digitally, the company purchases the equivalent physical gold on your behalf and stores it. Unlike physical gold, you don’t have to worry about its safekeeping.

How can you buy gold digitally?

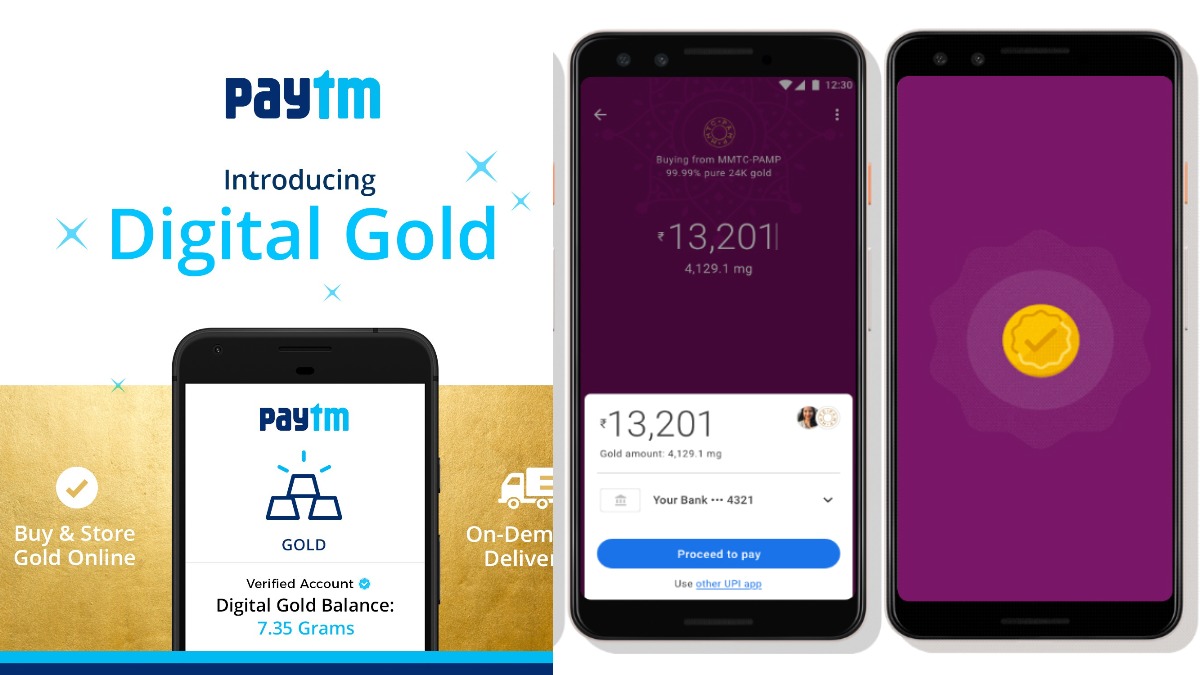

You can invest in digital gold through mobile e-wallet applications like Google Pay, PhonePe, Paytm, etc. Or through brokers like Motilal Oswal and HDFC Securities.

However, no matter which outlet you buy it from, digital gold is sold through three parent companies. Some apps give you the choice to choose your gold company.

The three digital gold companies are:

- MMTC-PAMP India Pvt. Ltd

- Augmont Gold Ltd.

- Digital Gold India Pvt. Ltd’s SafeGold

Most apps and websites in India trade gold using SafeGold and MMTC PAMP.

How can you trade gold online?

You can start with buying gold using the app of your choice. It can be for any amount. No matter how small the cost, you will have the equivalent weight in gold secured in your account.

The price of the gold depends on the live market and, you are free to sell a certain weight or cost of the gold whenever you wish to. If you want the physical weight in gold, you can also get it delivered to your doorstep!

What are the advantages?

Digital gold can be sold, bought, or delivered directly. It can be used as collateral for loans. This gold is genuine and has a purity of 99.5 percent 24K. It is stored in a secure place and, you don’t have to worry about its logistics.

The best part about it is that you can invest as low as Re 1!

Things to look out for

Remember that the limit on investing in gold online is usually Rs. 2 lakhs. It also lacks an official regulating body like the RBI. You may also have to pay a delivery fee if you wish to get it delivered.

But, on the whole, digital gold makes for an easy way to invest and save. You can buy some for yourself when you have spare cash, even if it’s just Rs. 20. After all, tiny drops form an ocean.