The billionaire owner of the Brooklyn Nets and co-founder of Alibaba, Joe Tsai, will take over as chairman of the Chinese e-commerce behemoth, the firm announced on Tuesday.

Tsai succeeds Daniel Zhang, a Taiwanese-Canadian billionaire who reportedly has a net worth of $7.7 billion. Zhang resigned to concentrate on Alibaba’s “crown jewel” cloud segment.

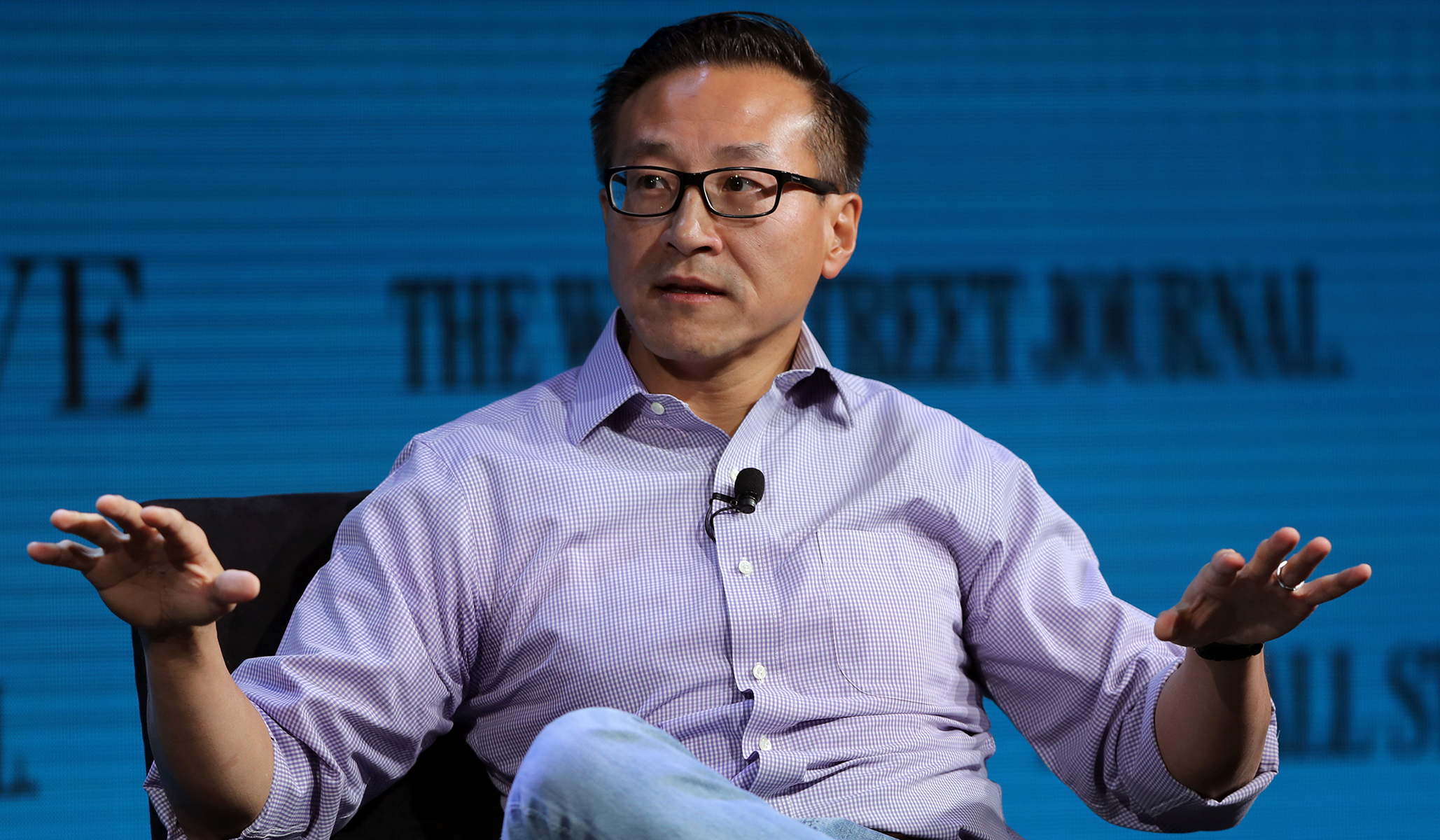

Who is Joseph Tsai?

Tsai, a Yale alumnus who assisted in the company’s founding in 1999, held the position of executive vice chairman until transitioning to the role of chief financial officer in 2013.

He invested $1 billion in 2017 to acquire 49% ownership in the Nets, and another $1.35 billion over three years to acquire control of both the organization and the Barclays Center. As chairman of Alibaba’s board of directors, he will succeed Zhang.

Prior to becoming CEO in 2019, Zhang, who joined Alibaba in 2007, served as the company’s “Singles Day” retail festival’s chief architect. The same year, he was elected chairman.

The CEO role will be handed over to Eddie Yongming Wu, a fellow co-founder who was previously serving as the chairman of Alibaba’s subsidiaries, Chinese online shopping platform Taobao and business-to-consumer website Tmall Group, Alibaba said in a statement.

“The appointment of Daniel to focus on running cloud is really a show of confidence and trust in him to take the most precious business and run with it to develop it in the right way given this age of generative artificial intelligence (AI),” former Alibaba employee Brian Wong told the media.

Wong continued: “The idea or expectation that one person could manage the business’ crown jewel Cloud and at the same time manage the entire Alibaba Group is an unreasonable expectation.”

Alibaba is in the process of splitting into six independently operated firms

According to Reuters, analysts pegged the value of Alibaba’s cloud division at $41 billion and $60 billion.

The largest cloud services platform in China, however, has already drawn the ire of domestic and international regulators over the large-scale cloud computing services it manages.

Following the news, Alibaba’s US-listed stock fell 2.48% in premarket trade on Tuesday.

The stock is down almost 70% from its peak in late 2020 as a result of China’s escalating tech crackdown.

After Beijing authorities tightened controls across the nation’s tech sector, Alibaba reorganized its operations.

The e-commerce company is in the process of splitting into six independently operated firms, which Alibaba has called “the most significant governance overhaul” since co-founder Jack Ma and Tsai and Wu founded the empire.

Each of the six organizations, according to Alibaba, “will be managed by its own CEO and board of directors.”

The decision to divide Alibaba’s activities allays a major worry voiced by Chinese Communist Party officials who were worried about the growing influence and strength of the e-commerce company, another internet behemoth Tencent, and other important digital companies.