Netflix Inc. is breaking all of its previous rules after losing customers for the first time in a decade. In the coming years, the streaming giant will launch a cheaper, ad-supported subscription option for users, and will begin cracking down on people who share their passwords even before that. As a result of the customer losses, Netflix will reduce its spending on movies and TV programming.

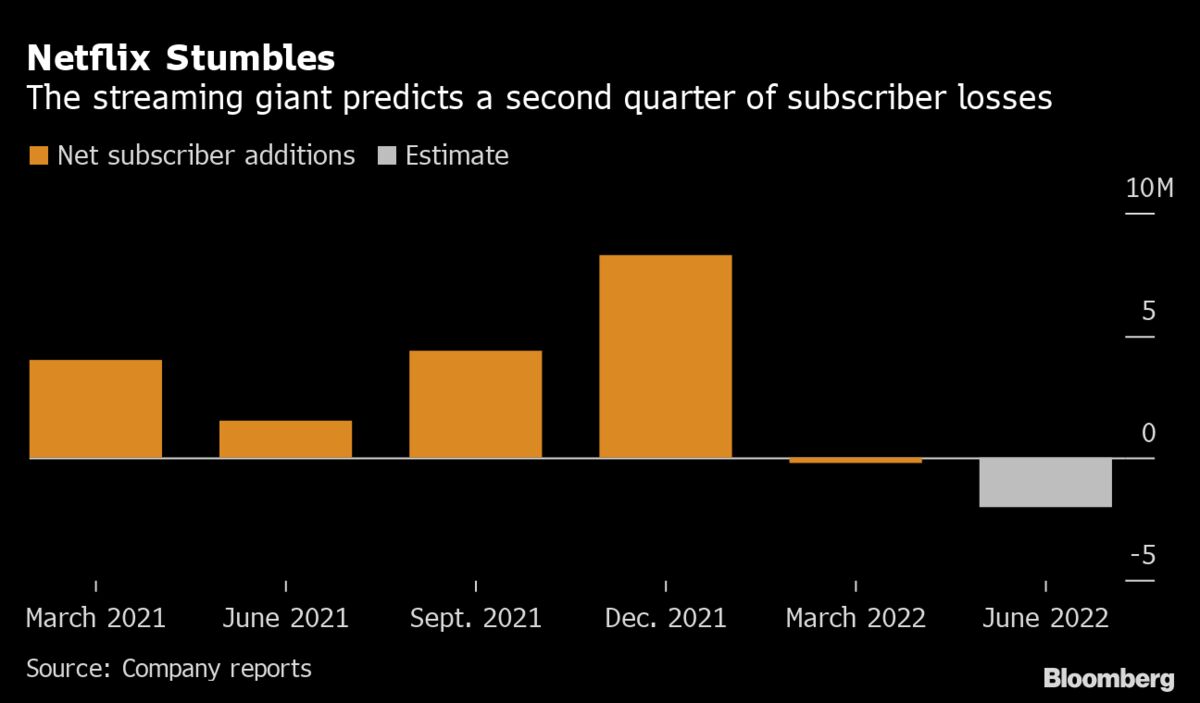

Reed Hastings, one of the company’s co-founders, has stated for years that he does not wish to give advertising and has no objections to password sharing. However, after losing 200,000 customers in the first quarter for the first time since 2011, the company is reversing course.

Netflix also expects to lose another 2 million users in the current quarter. It is a significant setback for a firm that used to grow by 25 million subscribers or more per year.

“It’s just shocking,” said analyst Michael Nathanson of MoffettNathanson LLC. “Everything they’ve tried to convince me of over the last five years was given up in one quarter. It’s such an about-face.”

Despite expectations from investors, analysts, and Hollywood executives for a slow start to the year, Wall Street still predicted Netflix to acquire 2.5 million new users in the first quarter. The stock, which had already lost more than 40% of its value this year, fell as much as 27% to $256 in after-hours trading.

Hastings and co-CEO Ted Sarandos had previously downplayed Netflix’s slowing member sign-ups as a speed hump caused by the pandemic. It propelled the company’s growth in 2020. The company’s growth, however, has not recovered to pre-pandemic levels.

Four causes

Four causes were cited by management, including the prevalence of password sharing and increased competitiveness. On top of its 221.6 million members, the corporation claims that more than 100 million homes utilize its service without paying for it. The firm is experimenting with new ways to sign up those viewers, such as charging those who share someone else’s subscription a higher fee.

“It allows us to bring in revenue for everyone who is viewing for gets value from entertainment we’re offering,” Chief Operating Officer Greg Peters said during an interview with analyst Doug Anmuth of JPMorgan Chase & Co.

Netflix’s problems should serve as a warning to its peers and competitors. After witnessing millions of customers ditch premium television in favor of streaming, major American entertainment companies combined and restructured to compete with Netflix. This strategy shift was embraced by investors, who boosted the stock of firms like Walt Disney Co. that indicating a commitment to streaming.

Investors are beginning to wonder if any of these media companies will be able to sign up enough subscribers to justify the money spent on new programming. Following Netflix’s estimate, Disney shares plummeted as much as 5.2 percent in extended trade, while Warner Bros. Discovery Inc., which owns HBO Max, sank as high as 2.8 percent. Roku Inc., a provider of streaming set-top boxes, saw its stock tumble as high as 8.3%.

All of these rivals offer or plan to offer advertising-supported services shortly. Analysts and competitors have predicted for years that Netflix will provide advertising, only for Hastings to reject it. Netflix has always claimed that its subscribers prefer its service over cable television because it is free of advertisements. Hastings also didn’t want to compete in the internet ad market with Google and Facebook. Nonetheless, he has finally given in.

Makes sense

“Allowing consumers who would like to have a lower price and are ad tolerant makes a lot of sense,” Hastings said Tuesday. Netflix will explore the best way to offer advertising over the next couple of years.

Password sharing is a danger for a company that began by offering clients a less expensive and more convenient alternative to cable. Netflix comes to resemble what it replaced by urging viewers to pay and introducing advertising.

However, the company requires assistance after losing clients in three of its four regions during the first quarter, including over 600,000 in the United States and Canada. Netflix attributed the majority of the decrease to a price hike and stated that the drop was expected. The corporation lost another 700,000 clients as a result of Russia’s invasion of Ukraine. Thereby, resulting in a total loss of 300,000 customers throughout Europe, the Middle East, and Africa.

Overall, Netflix predicted a 2.5 million increase in members in the first quarter, about in line with Wall Street expectations. Analysts predicted gains of 2.43 million for the current quarter. Revenue increased 9.8% to $7.87 billion in the first quarter, falling short of experts’ expectations. Profit of $3.53 per share substantially outperformed expectations of $2.91.

No Explanation

“They were never able to explain why or how growth was slowing,” Nathanson said. “Now they’ve decided growth is slowing. How did this change in two quarters?”

The only bright spot was Asia. Netflix in the region acquired more than 1 million new subscribers, boosted by popular new titles. It also includes the South Korean thriller “All of Us Are Dead.”

Outside of the United States, Netflix continues to outperform most of its competitors and is the world’s largest streaming service. The corporation believes that by recruiting new customers with better programs and finding new methods to charge its present user base, it can get out of its current dilemma. The firm still intends to gain customers this year. The second part of the year will feature a more robust lineup of new shows.