Governments around the world are in a monetary crisis. You might have thought, ” If we’re short of money, the government can just print more.” However, that’s not true. The government cannot just print money whenever they want. It is not possible due to Inflation.

What is Inflation?

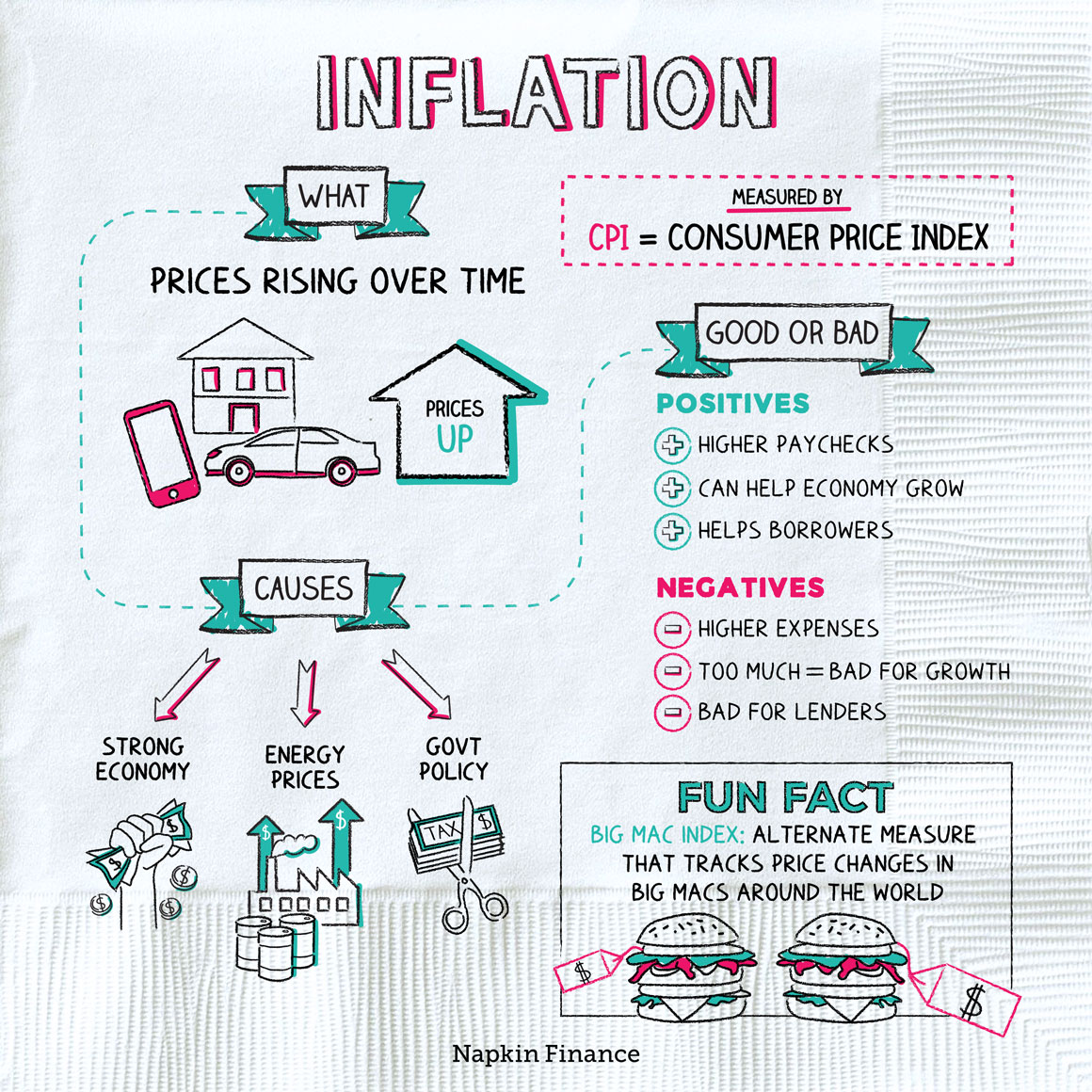

Inflation is the rise in prices of services and goods we use every day. In other words, it is the decline of a currency’s purchasing power over time. It tells us about the rate at which a currency’s value is reducing. In the early day, nations printed money blindly and it led to an increase in prices. In the end, normal citizens could not afford everyday necessities. This infographic by Napkin Finance can help in understanding it.

One of the most common examples of this is in the price of milk. In 1913, the price of a gallon of milk was 36 cents. However, one 100 years later, in 2013, a gallon of milk is 10 times higher i.e., $3.53. Another famous example is Germany in the 1920s. Citizens needed to pay barrows full of cash to pay for everyday goods. So, the spiraling increase in prices has more to do with fixing reparation payments than with printing or making more money.

The reason behind not printing more money

Governments can’t print more money as and when they want because they are not in charge of this. In most countries, national banks and authorities like the US Federal Reserve, European Central Bank, or the Bank of England are in charge of overseeing the supply of money. They are independent and coordinate with the government.

Moreover, central banks and reserves cannot mint money to free debt because international investors can lose confidence in a country’s stability and economy. Because this will be seen as a central agency financing the government directly. If this happens, exchange rates will plummet and poor countries will become poorer.